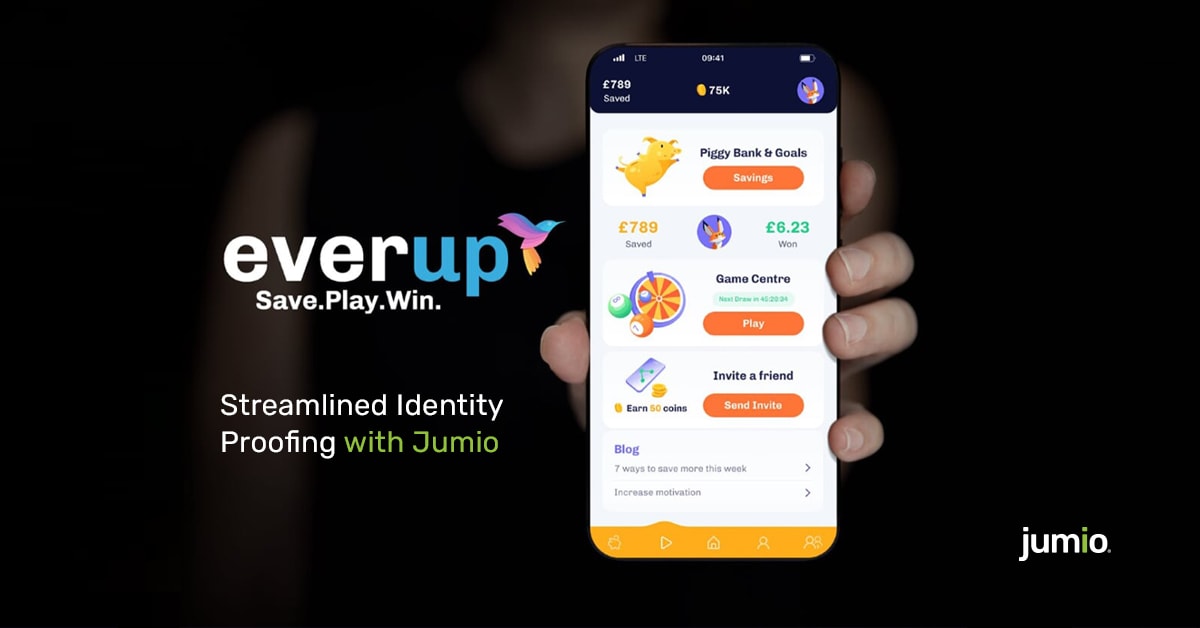

The prize-linked savings app EverUp has chosen Jumio’s AI-powered identity verification solutions to drive its customer onboarding and authentication processes, all while deterring fraud and meeting regulatory mandates.

EverUp is a prize-linked savings startup, launching in January the first UK digitally-native prize-linked money* account. EverUp customers will earn virtual coins based on how much they are saving and as they perform other actions, such as signing up, opening an account, logging in, levelling up and inviting friends to join. The more customers save, the more they will be rewarded with coins that can be used to play games, for the chance to win tax-free cash prizes. Customers never use their own money to play and can withdraw their funds at any time, with no fees.

In choosing Jumio, EverUp will be able to reliably and securely verify the identities of new users by having them first capture a picture of their government-issued ID and then take a corroborating selfie. This process ensures that the user is who they claim to be and physically present during the process. EverUp will also use Jumio Authentication to verify the digital identities of existing customers on an ongoing basis.

Giuseppe Caltabiano, CEO and Co-founder at EverUp, said: “We have chosen Jumio because we wanted a fast, customer-centric solution, that would offer a seamless and streamlined customer onboarding experience and ID verification, while meeting the KYC, AML and GDPR compliance requirements.”

“EverUp aims to gamify the savings accumulation and apply its prize-linked and gamification approach to other aspects of our personal finance life. Rewards drive engagement, putting a habit-forming pleasure into a compelling proposition. A prize-linked proposition is about helping our customers build positive habits. Making things fun is solving a problem and having fun while achieving a goal makes it feel magical. We aim to turn a boring product into a fun product, so that we can turn non-savers into savers.”

Robert Prigge, CEO at Jumio, said: “We are delighted to partner with EverUp and support their mission to make saving fun. We look forward to helping EverUp meet growing verification volumes, streamline KYC compliance andscale across geographies.”

Watch this video to learn more about EverUp’s decision to use Jumio’s AI-powered solutions.

About Jumio

When identity matters, trust Jumio. Jumio’s mission is to make the internet a safer place by protecting the ecosystems of businesses through a unified, end-to-end identity verification and eKYC platform. The Jumio KYX Platform offers a range of identity proofing and AML services to accurately establish, maintain and reassert trust from account opening to ongoing transaction monitoring.

Leveraging advanced technology including AI, biometrics, machine learning, liveness detection and automation, Jumio helps organizations fight fraud and financial crime, onboard good customers faster and meet regulatory compliance including KYC, AML and GDPR. Jumio has verified more than 300 million identities issued by over 200 countries and territories from real-time web and mobile transactions. Jumio’s solutions are used by leading companies in the financial services, sharing economy, digital currency, retail, travel and online gaming sectors. Based in Palo Alto, Jumio operates globally with offices in North America, Latin America, Europe and Asia Pacific and has been the recipient of numerous awards for innovation. For more information, please visit www.jumio.com.

About EverUp

EverUp is a prize-linked savings startup, launching the first UK digitally-native prize-linked money account* that rewards customers for saving by giving them a chance to win tax-free cash prizes. EverUp’s mission is to make saving fun and get everyone saving. EverUp aims to build over time a full-scale financial hub where their customers can accomplish all types of financial transactions, while being rewarded for solidifying good financial behaviours through a prize-linked and gamified suite of personal finance products.

EverUp Ltd, based in London, is a registered EMD agent of Modulr FS Limited which is an electronic money institution authorised by the Financial Conduct Authority (FRN: 900573). EverUp Ltd is listed on the Financial Services Register with reference no. 902939. EverUp has been accepted into the FCA Innovation Hub – Direct Support function.

*Disclaimer: The EverUp savings app is not a savings account provided by a bank. It is an e-money account provided by Modulr under its EMI licence. The EverUp savings app does not pay any interest or dividends.

For more information, please visit www.everup.uk

Media Contacts

U.S. Media Contact

Alex Mercurio

10Fold Communications

[email protected]

925-271-8227

Europe Media Contact

Gemma Lingham

FleishmanHillard Fishburn

[email protected]

+44-7525-699-347