Filter by

Most Recent

- Most Recent

- Most popular

All time

- All time

- This Month

- This Year

When Regulations Collide: GDPR and AML Compliance

What is GDPR? The General Data Protection Regulation (GDPR) is designed to protect the data privacy of EU citizens. Every company that processes the data of EU citizens, regardless of where that company is located, must comply with GDPR policies. The fines for non-compliance are huge: up to €20 million (~$22 million) or up to 4% of the…

CCPA 2020: What Businesses Need to Know About the California Consumer Privacy Act [Infographic]

Our digital and physical worlds are becoming increasingly inseparable, with 81% of American adults going online on a daily basis, according to a recent Pew Research Center survey. Consumers can do everything from renting a vacation home to opening a new bank account with just a few clicks and swipes. In the process they’re leaving…

Demystifying Strong Customer Authentication: A Simple Path to PSD2 Compliance

This month, the UK’s Financial Conduct Authority (FCA) confirmed an 18-month delay to the introduction of Strong Customer Authentication (SCA) rules in order to give financial and retail firms a little breathing room to prepare. “The FCA has been working with the industry to put in place stronger means of ensuring that anyone seeking to…

How Asia-Pacific Banks Can Get eKYC Right [Infographic]

Asia-Pacific smartphone adoption is through the roof, and nine countries in Asia already have the same or higher smartphone ownership rate than the U.S. This skyrocketing mobile device adoption is a positive step for APAC banks and financial institutions when it comes to customer onboarding. Consumers increasingly expect that their online banking experience should be…

New Regulations Usher in the Age of AML for Canadian Banks and Fintechs

Updates to Canada’s anti-money laundering (AML) and anti-terrorist funding (ATF) regulations are about to make customer onboarding and compliance much easier for banks and fintechs because they change the way end users can verify their identities. The Government of Canada recently published new regulation amendments to the Proceeds of Crime (Money Laundering) and Terrorist Financing…

Why Online Identity Verification is Essential to CCPA Compliance

The California Consumer Privacy Act, or CCPA, is an unprecedented privacy law going into effect January 1, 2020. CCPA is expected to be the strictest data privacy law in the U.S. and will accomplish three major objectives, giving California residents the right to: Know what information businesses are collecting about them Tell a business not…

FaceApp: Photoshopping on Steroids

Check out the before and after pictures The Jonas Brothers created with FaceApp. While the app has been around since 2017, it’s gone viral in the last week as people use it to see how they would look when they’re older. Pretty cool. Pretty innocuous. Well, maybe, not so much. Let’s start with FaceApp’s own…

5 Killer Mistakes When Onboarding New Players in Online Gaming

When it comes to online gaming, there are a number of converging regulatory trends that are challenging operators’ ability to quickly verify and onboard new players. If you’re a UK-based operator, you now have to contend with new UKGC rules to prevent underage gambling. These new rules prevent players from gambling until their name, address…

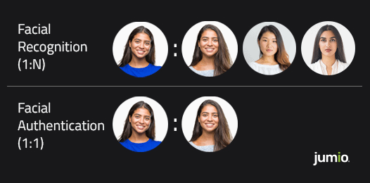

Facial Identification Explained: Face Recognition vs. Facial Authentication

There’s a healthy degree of confusion between facial recognition and facial authentication, but the underlying technologies are often very different and designed to address different use cases. With the launch of Apple iPhone X and its successors, facial recognition has gone mainstream and helped consumers recognize that their faces could serve as their password. In…

6 Glaring Limitations of OCR for Identity Verification

We’re starting to observe a new market phenomenon: the rise of DIY online identity verification and efforts by companies to cobble together OCR technology, facial recognition software and low-cost manual review teams. Want to learn more now? Download Jumio’s eKYC in APAC Guide. At its face, this approach makes some sense, but it’s important to understand…

How APAC Fintechs and Banks Can Get eKYC Right

Banks are striving to grow their customer base through faster, easier and lower-cost digital channels. Yet, the current regulatory and cybersecurity landscape creates a layer of complexity. Consumers want the convenience of signing up through digital channels, but financial institutions must comply with stringent anti-money laundering (AML) and know your customer (KYC) regulations that typically…

The Sudden Emergence of KYP: Know Your Patient

Over the last decade, there have been over 2,550 health care data breaches impacting more than 175 million medical records. That’s the equivalent of affecting more than 50 percent of the U.S. population. What’s not commonly understood is that medical records command a high value on the dark web. These medical records can be listed…