At its face, online identity verification seems pretty straight forward.

Ask the user to capture a picture of their government-issued ID (passport or driver’s license), take a selfie to make sure he/she is the same person depicted on the ID, and get a verification decision — thumbs up or down.

Each vendor has their own black box to determine which IDs and identities get accepted and which ones get rejected. But, given the range of technologies being deployed to answer that question, it’s time to open the kimono and really understand what makes those black boxes tick.

Most of the vendors in our space talk about AI and machine learning. They talk about the expected outputs of their online verification process — reduced fraud, improved conversion rates (for setting up customer accounts), and KYC/AML compliance. We are no different.

What about the inputs? What’s under the hood? And, most importantly, how effective are they at delivering on those promises?

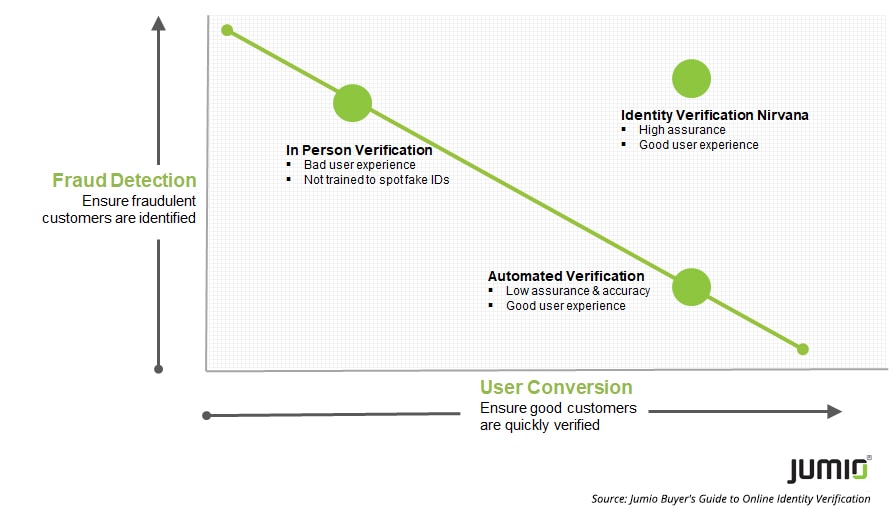

The fact is there are inherent trade-offs that most online verification companies often have to make between deterring fraud and increasing conversion rates. You could either have higher levels of fraud detection by forcing customers to visit a branch office which necessarily adds friction to attain higher levels of identity assurance. Conversely, you could opt for higher levels of conversion rates which often meant reducing the friction during the account setup process. But, this meant accepting lower levels of assurance). So, pick your poison—higher levels of fraud detection with lower conversion rates or opt for higher conversion rates with lower levels of fraud detection/assurance.

A False Trade-Off: Fraud Detection vs. User Conversion

The challenge with purely automated solutions is that they often lack the requisite functionality, hybrid processes and geographic scope to move to the upper right part of this chart. But, the fact is, online companies can get higher conversion rates and better fraud detection if the right features, processes and technologies are part of the solution.

Some of these include…

- Machine learning

- Data tagging

- Liveness detection

- ID version support

- Human review by verification experts

- Omni-channel support

- Fraud database

- Geographic coverage

- Blur & glare detection

- Expired ID detection

It’s important to understand these underlying features to better assess whether an online identity verification vendor can really deliver on their promises.

That’s why we created the Buyer’s Guide to Online Identity Verification which spells out some of the key functionalities, technologies and processes in greater detail that should be compared and considered when shopping for different identity verification solutions.

As a bonus, we included 12 best practices for performing a competitive bake-off and developing a testing plan to help you make a confident, data-based decision on the best online identity verification solution for your needs. After all, the best way to test the claims of accuracy and verification speed of a given verification solution is to test it, but under real-life circumstances.